Highlights:

-

RC Drilling Continues on 100% Controlled South Block Expansion Zone

-

Expanding Known Mineralization to the North

-

Drillhole JES-25-114 Returns 41.2 meters of 1.0 g/t Au and 10 g/t Ag

Including 6.1 meters of 5.4 g/t Au and 39 g/t Ag

Anomalous mineralization recorded over 129.6 meters averaging 0.3 g/t Au and 4 g/t Ag

Coincides with Geophysical Anomaly (Resistivity) that extends 250 meters vertically

-

-

Results Pending for Seven RC Holes

Including follow-up on 3.1m of 19.4 g/t Au, within 106.6m of 0.6 g/t Au (JES-24-101)

-

CALGARY, AB / ACCESS Newswire / May 7, 2025 / Tocvan Ventures Corp. (the "Company") (CSE:TOC)(OTCQB:TCVNF)(WKN:TV3/A2PE64), is pleased to announce initial reverse circulation (RC) drill results from the latest drill program at the Gran Pilar Gold-Silver Project in mine-friendly Sonora, Mexico. Drilling is now focused on the 100% controlled expansion area where recent scout drilling returned significant mineralization (see February 25, 2025 News Release). Today's results include a follow-up on scout drillhole JES-24-102, which previously returned 16.8 m of 0.4 g/t Au and 6 g/t Ag. Results are highlighted by 6.1 meters of 5.4 g/t Au and 39 g/t Ag within 41.2 meters of 1.0 g/t Au and 10 g/t Ag from a downhole depth of 33.6 meters, or approximately 20 meters vertically from surface (JES-25-114). This hole represents the furthest northeast high-grade occurrence intersected to date, and follow-up drilling is underway to determine if this mineralization connects to the 4-T corridor, which is well-defined 380 meters to the southeast. The discovery coincides with a resistivity anomaly that extends 250 meters vertically as defined by a Controlled Source Audio-Frequency Magnetotellurics (CSAMT) survey, seen in Figure 2. JES-25-114 also lies 170 meters east of JES-24-101 (3.1 meters of 19.4 g/t Au within 106.6 meters of 0.6 g/t Au), and the close association of high-grade gold with an intrusive unit in both holes suggests they may be part of the same mineralized trend. Follow-up drilling on JES-24-101 has been completed, and mapping of the surrounding area has identified underground workings further north. RC drilling in this area has intersected multiple vein zones that appear similar to the mineralized intervals discovered in JES-24-101, with results for these holes currently pending.

Results are pending for seven RC drill holes, including follow-up drilling on JES-24-101, which intersected 3.1 meters of 19.4 g/t Au within 106.6 meters of 0.6 g/t Au.

"We are thrilled with these initial results from our latest drilling program at Gran Pilar, which continue to demonstrate the significant near-surface, high-grade potential of the project," commented Brodie Sutherland, CEO of Tocvan Ventures Corp. "The discovery of another high-grade corridor in the expansion area, coupled with its association with a geophysical anomaly that extends 250 meters vertically, underscores the scale and continuity of mineralization at Gran Pilar. With results pending for seven more holes, including follow-up on the exceptional grades intersected in JES-24-101, we are eager to further define this emerging zone and unlock its full potential. These results, combined with the robust economics of our planned pilot facility, position Gran Pilar as a standout gold-silver project in Sonora, especially in the context of record-high gold prices."

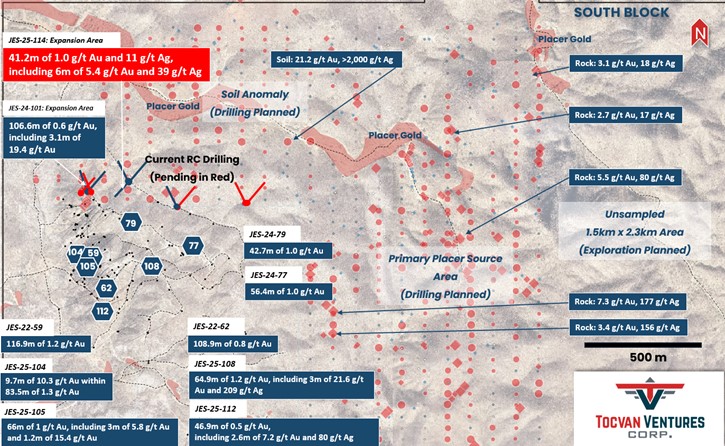

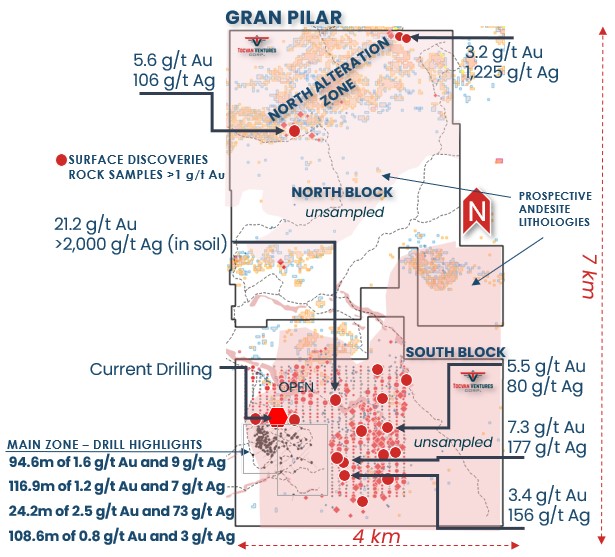

Figure 1. Planview target map of the South Block area where drilling is currently active. Undrilled target areas extend a kilometer north and 1.5 kilometers to the east. Recent drill results are highlighted. Red circles are soil samples with anomalous gold. Red diamonds are rock samples with anomalous gold.

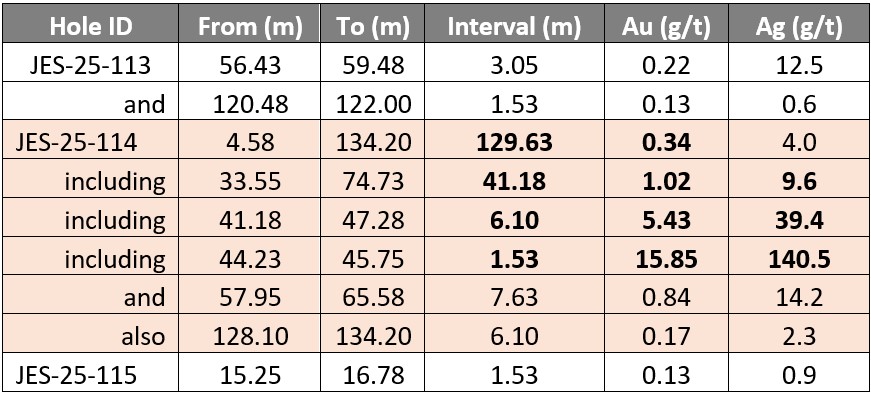

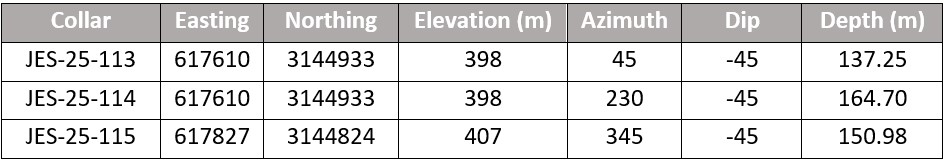

Table 1. Summary of Drill Results in today's release. Intervals reported are drilled lengths, currently there is insufficient information to determine true widths.

Discussion of Results

JES-25-113: This drillhole intersected two mineralized zones, with the first interval returning 3.05 meters of 0.22 g/t Au and 12.5 g/t Ag from 56.43 meters, and a second interval of 1.53 meters of 0.13 g/t Au and 0.6 g/t Ag from 120.48 meters. These results indicate the presence of low-grade mineralization at depth, potentially extending the mineralized footprint in this area. Pathfinder geochemistry also suggests proximity to mineralization with zones (0.0 to 19.8m and 47.3 to 137.3m) of elevated arsenic up to 3,500 ppm.

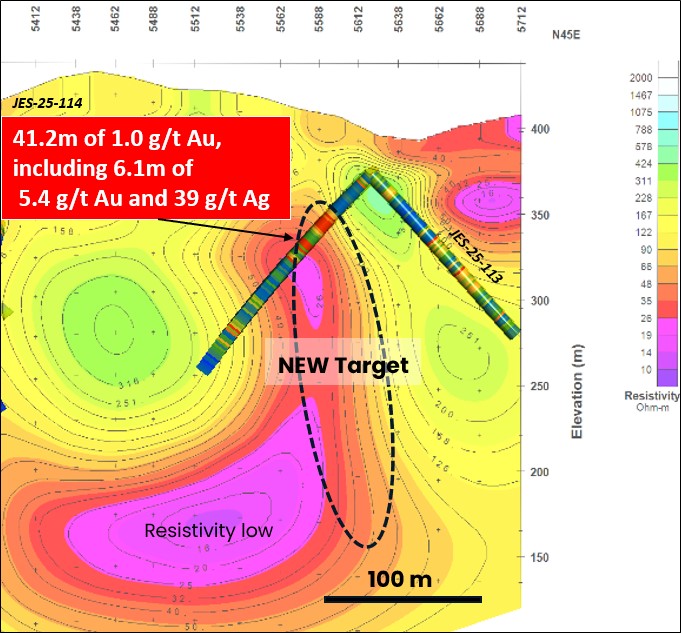

JES-25-114: This drillhole returned significant mineralization, with a broad interval of 129.63 meters grading 0.34 g/t Au and 4.0 g/t Ag starting at 4.58 meters downhole. Within this, a higher-grade zone of 41.18 meters at 1.02 g/t Au and 9.6 g/t Ag was intersected, including 6.10 meters of 5.43 g/t Au and 39.4 g/t Ag, and a peak interval of 1.53 meters at 15.85 g/t Au and 140.5 g/t Ag. Additional mineralized zones include 7.63 meters of 0.84 g/t Au and 14.2 g/t Ag, and 6.10 meters of 0.17 g/t Au and 2.3 g/t Ag. The high-grade section correlates with a sharp drop in resistivity, suggesting fault and contact-related mineralization, as seen in the CSAMT inversion model (Figure 2).

JES-25-115: This drillhole intersected a narrow interval of 1.53 meters grading 0.13 g/t Au and 0.9 g/t Ag from 15.25 meters, indicating minor mineralization closer to the surface. Pathfinder geochemistry also suggests proximity to mineralization with arsenic elevated from surface down to 125.1 meters depth.

Figure 2. Cross-section looking northwest showing drillhole JES-25-114 plotted with a CSAMT inversion model of Resistivity. The high-grade section of the drill hole correlates with a sharp drop in resistivity which is thought to be fault- and contact- related. The depth extension of the target area remains untested, the target also remains open along strike several hundred meters to the northwest and southeast.

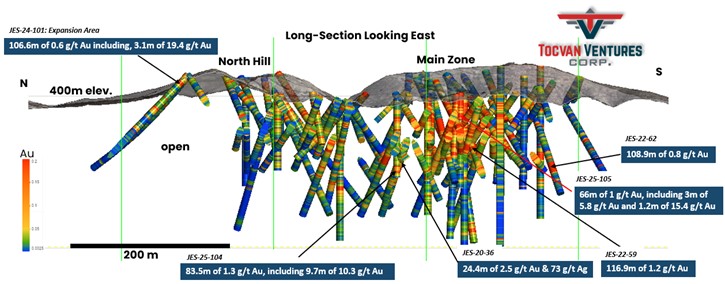

Figure 3. 3D Long Section of the Main Zone and the new Expansion Target to the north (left side of image). Results are pending for seven RC drillholes.

Table 2 Summary of drill collar locations and orientations. Coordinates are in UTM NAD 27, Zone 12N

Figure 4. Gran Pilar Project Overview, > 22km2 of prospective ground with two primary targets: South Block, the direct extension and expansion of the historic Main Zone defined by an expanding vein field of untested drill targets; North Block a 3.2-km by 1.5-km pyrite and clay alteration zone that coincides with high-grade gold-silver, the area remains largely untested.

Gran Pilar Drill Highlights:

-

2024 RC Drilling Highlights include (all lengths are drilled thicknesses):

42.7m @ 1.0 g/t Au, including 3.1m @ 10.9 g/t Au

56.4m @ 1.0 g/t Au, including 3.1m @ 14.7 g/t Au

16.8m @ 0.8 g/t Au and 19 g/t Ag

-

2022 Phase III Diamond Drilling Highlights include (all lengths are drilled thicknesses):

116.9m @ 1.2 g/t Au, including 10.2m @ 12 g/t Au and 23 g/t Ag

108.9m @ 0.8 g/t Au, including 9.4m @ 7.6 g/t Au and 5 g/t Ag

63.4m @ 0.6 g/t Au and 11 g/t Ag, including 29.9m @ 0.9 g/t Au and 18 g/t Ag

-

2021 Phase II RC Drilling Highlights include (all lengths are drilled thicknesses):

39.7m @ 1.0 g/t Au, including 1.5m @ 14.6 g/t Au

47.7m @ 0.7 g/t Au including 3m @ 5.6 g/t Au and 22 g/t Ag

29m @ 0.7 g/t Au

35.1m @ 0.7 g/t Au

-

2020 Phase I RC Drilling Highlights include (all lengths are drilled thicknesses):

94.6m @ 1.6 g/t Au, including 9.2m @ 10.8 g/t Au and 38 g/t Ag;

41.2m @ 1.1 g/t Au, including 3.1m @ 6.0 g/t Au and 12 g/t Ag ;

24.4m @ 2.5 g/t Au and 73 g/t Ag, including 1.5m @ 33.4 g/t Au and 1,090 g/t Ag

-

15,000m of Historic Core & RC drilling. Highlights include:

61.0m @ 0.8 g/t Au

21.0m @ 38.3 g/t Au and 38 g/t Ag

13.0m @ 9.6 g/t Au

9.0m @ 10.2 g/t Au and 46 g/t Ag

Pilar Bulk Sample Summary:

62% Recovery of Gold Achieved Over 46-day Leaching Period

Head Grade Calculated at 1.9 g/t Au and 7 g/t Ag; Extracted Grade Calculated at 1.2 g/t Au and 3 g/t Ag

Bulk Sample Only Included Coarse Fraction of Material (+3/4" to +1/8")

-

Fine Fraction (-1/8") Indicates Rapid Recovery with Agitated Leach

Agitated Bottle Roll Test Returned Rapid and High Recovery Results: 80% Recovery of Gold and 94% Recovery of Silver after Rapid 24-hour Retention Time

Additional Metallurgical Studies:

-

Gravity Recovery with Agitated Leach Results of Five Composite Samples Returned

95 to 99% Recovery of Gold

73 to 97% Recovery of Silver

Includes the Recovery of 99% Au and 73% Ag from Drill Core Composite at 120-meter depth.

Based on management's strong belief in the project's potential, the Company is outlining a permitting and operations strategy for a pilot facility at Pilar. The facility would underpin a robust test mine scenario with aims to process up to 50,000 tonnes of material. Timelines and budget are being prepared with the aim of moving forward with the development early in 2025. With gold prices hitting all-time highs, the Company believes the onsite test mine will provide key economic parameters and showcase the mineral potential of the area. In 2023, the Company completed an offsite bulk sample that produced important data showcasing the potential to recover both gold and silver through a variety of methods including heap leach, gravity and agitated leach (see August 22, 2023, news release for more details).

Market-Making Services

The Company is pleased to announce that it has retained Integral Wealth Securities Limited ("Integral") to provide Market-Making services in accordance with the Canadian Securities Exchange ("CSE") policies. Integral will trade securities of the Company on the CSE for the purposes of maintaining an orderly market of the Company's securities.

The agreement between the Company and Integral (the "Agreement") executed on May 5, 2025 is for an initial term of three months. The Agreement outlines that Integral will receive compensation of CAD $6,000 per month, with the first monthly payment paid on the signing of the Agreement by the Company, and thereafter, the fee will be payable on the first day of each month. After the third month, the Company may terminate the Agreement on 30 days written notice. There are no performance factors in the agreement and Integral will not receive shares or options as compensation.

The Company and Integral are unrelated and unaffiliated entities. Integral is a member of the Canadian Investment Regulatory Organization ("CIRO") and can access all Canadian Stock Exchange and Alternative Trading Systems. The capital and securities required for any trade undertaken by Integral as principal will be provided by Integral.

Integral Wealth Securities Limited is an independent CIRO-licensed investment dealer engaged in market making, investment banking and wealth management. Headquartered in Toronto, the firm operates from nine offices across Canada. The firm's FINRA-licensed US broker dealer affiliate, Integral Wealth Securities LLC, is based in Malvern, PA and provides investment banking as well as private placement services.

Integral and its clients may acquire an interest in the securities of the Company in the future. Integral is an arm's length party to the Company. Integral will be responsible for the costs it incurs in buying and selling the Company's common shares, and no third party will be providing funds or securities for the market making activities.

Marketing Engagement

Tocvan is also pleased to announce that the Company has signed a service agreement, dated May 6th, 2025, with TMM Capital Advisory, to develop and execute on investor relations, marketing and communications strategies, including managing shareholder communications, organizing investor presentations and meetings, handling media relations, preparing press releases, and website and social media management. TMM Capital Advisory shall receive CAD $5,000 per month over the duration of the agreement (minimum 12 months).

About TMM Capital Advisory (https://www.tmmcapitaladvisoryinc.com/)

At TMM, we work directly with business leaders and innovators and specialize in providing strategic guidance to help our clients navigate the complexities of the capital market and help drive organizational value. We pride ourselves on our commitment to providing tailored solutions that meet the unique needs of each of our clients. TMM can be contacted direct via the email tmuir@tmmcapitaladvisoryinc.com or by phone at +1 (888) 772-2452

About Tocvan Ventures Corp.

Tocvan's advancing gold-silver projects are located in the mine-friendly jurisdiction of Sonora, Mexico. Through ongoing exploration programs, the Company is unveiling the high-potential at its Gran Pilar Gold-Silver Project where it holds 100% interests in over 21 square kilometers of prospective area and a majority ownership (51%) in a one square kilometer area shared with Colibri Resources. The Company also holds 100% interest in the Picacho Gold-Silver project in the Caborca Trend of northern Sonora, a trend host to some of the major gold deposits of the region. Management feels both projects represent tremendous opportunity to create shareholder value.

Tocvan has approximately 59 million shares outstanding.

Quality Assurance / Quality Control

Rock and Drill samples were shipped for sample preparation to ALS Limited in Hermosillo, Sonora, Mexico and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold was analyzed using 50-gram nominal weight fire assay with atomic absorption spectroscopy finish. Over limits for gold (>10 g/t), were analyzed using fire assay with a gravimetric finish. Silver and other elements were analyzed using a four-acid digestion with an ICP finish. Over limit analyses for silver (>100 g/t) were re-assayed using an ore-grade four-acid digestion with ICP-AES finish. Control samples comprising certified reference samples and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's robust quality assurance / quality control protocol.

Soil Samples were shipped for sample preparation to ALS Limited in Hermosillo, Sonora, Mexico and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold and multi-element analysis of soils was completed by aqua regia digestion and ICP-MS finish using a 50-gram nominal weight. Over limit gold values greater than 1 g/t were re-assayed with a more robust aqua regia digestion ad ICP-MS finish. Over limit analyses for silver (>100 g/t) were re-assayed using an ore-grade four-acid digestion with ICP-AES finish. Control samples comprising blank samples and certified reference materials were systematically inserted into the sample stream and analyzed as part of the Company's robust quality assurance / quality control protocol.

Brodie A. Sutherland, CEO for Tocvan Ventures Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

Cautionary Statement Regarding Forward Looking Statements

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the

Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains "forward-looking information" which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Forward-looking information in this news release includes statements regarding the use of proceeds from the Offering. Such forward-looking information is often, but not always, identified by the use of words and phrases such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risks related to the speculative nature of the Company's business, the Company's formative stage of development and the Company's financial position. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws.

There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

For more information, please contact:

TOCVAN VENTURES CORP.

Brodie A. Sutherland, CEO

1150, 707 - 7 Ave SW

Calgary, Alberta T2P 3H6

Telephone: 1-888-772-2452

Email: ir@tocvan.ca

STAY CONNECTED:

LinkedIn: TOC LinkedIn

X: TOC X

Facebook: TOC Facebook

YouTube: TOC YouTube

Web:tocvan.com

Latest Webinar: May 2, 2025 Company Update

SOURCE: Tocvan Ventures Corp

View the original press release on ACCESS Newswire