Pricing in the junk car market has long been shaped by limited buyer access and opaque valuation methods, often preventing sellers from seeing what their vehicles are actually worth. In many cases, cash offers are generated by a single buyer or a lead-based system that prioritizes speed over price accuracy, resulting in offers that fail to reflect real market demand.

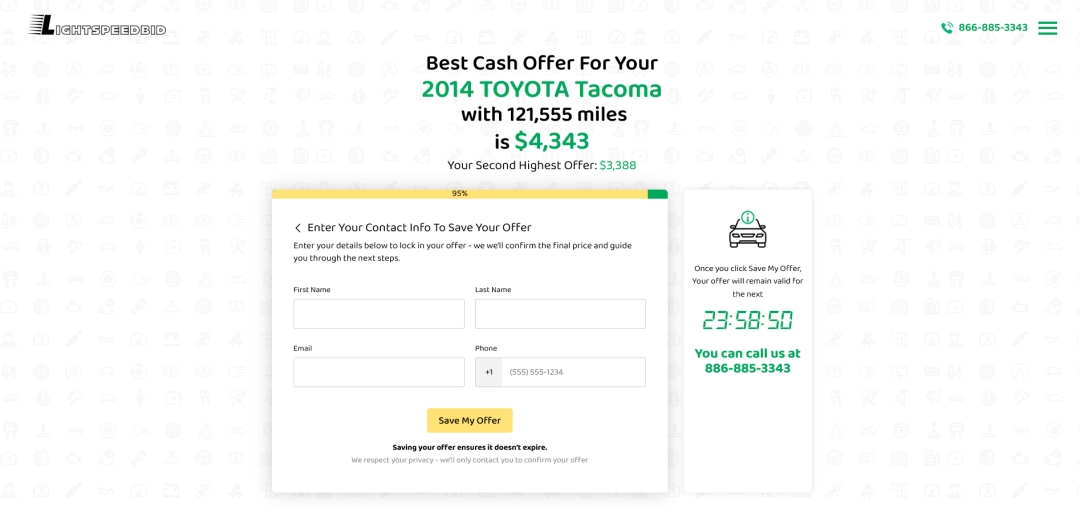

Recent changes in cash offer calculator technology are beginning to alter that dynamic. By expanding buyer networks and introducing stronger offer verification mechanisms, modern pricing platforms are now able to surface cash offers that more closely align with how vehicles are valued across the broader market.

According to analysis published by LightSpeedBid, expanding the number of active buyers evaluating the same vehicle increases pricing competition while reducing the likelihood of failed pickups and last-minute price changes. The findings are outlined in a newly released in-depth article examining how buyer competition and verification impact junk car pricing outcomes.

Market context: why junk car pricing has lagged behind

Unlike retail auto sales, junk car pricing has historically lacked transparency and standardization. Offers are influenced by a mix of regional demand, scrap pricing, parts resale value, export interest, and towing logistics. Yet most sellers interact with only one buyer at a time, limiting price discovery and shifting leverage toward the buyer.

Lead-based junk car websites have reinforced this structure by distributing vehicle information widely without controlling how buyers price, verify, or complete transactions. The result has been a market where high initial offers frequently change at pickup, and sellers struggle to distinguish between competitive pricing and placeholder quotes.

Data insight: buyer competition and offer verification

Analysis of pricing behavior across expanded buyer networks shows that competition plays a central role in improving seller outcomes. When multiple buyers simultaneously evaluate a vehicle, pricing reflects a broader range of demand signals, including parts resale, export value, and regional logistics efficiency.

Equally important is offer verification. Verified offers are backed by confirmed buyer acceptance and realistic pickup logistics, significantly reducing the risk of price collapse at pickup. Platforms emphasizing verification over inflated top-line pricing tend to deliver more consistent transaction outcomes for sellers.

“What sellers often experience isn’t deception, but a lack of visibility into how offers are formed and adjusted,” the analysis notes. “Verification and buyer competition work together to produce offers that are both competitive and reliable.”

Implications for sellers and the vehicle buyout industry

For sellers, expanded buyer networks and verified pricing translate into fewer phone calls, less negotiation, and offers that more accurately reflect what the market is willing to pay. Instead of shopping quotes manually, sellers can see the result of real buyer competition in a single step.

For the industry, these changes signal a gradual shift away from lead-driven pricing toward structured price discovery. As transparency and verification become more common, pricing practices may begin to standardize around market-aligned valuation rather than convenience-based offers.

The full analysis, including detailed explanations of buyer competition, pricing inputs, and verification mechanics, is available in the accompanying article published by LightSpeedBid.

About LightSpeedBid

LightSpeedBid is a vehicle pricing platform that compares offers from vetted local and nationwide buyers to present a single verified cash offer based on current market demand. The platform focuses on pricing transparency, buyer reliability, and streamlined vehicle buyout processes.

Media Contact

Company Name: LightSpeedBid

Contact Person: Brad Thomas

Email: Send Email

Phone: 866-885-3343

Address:1045 Elm St. Suite 204

City: Manchester

State: NH

Country: United States

Website: https://lightspeedbid.com/