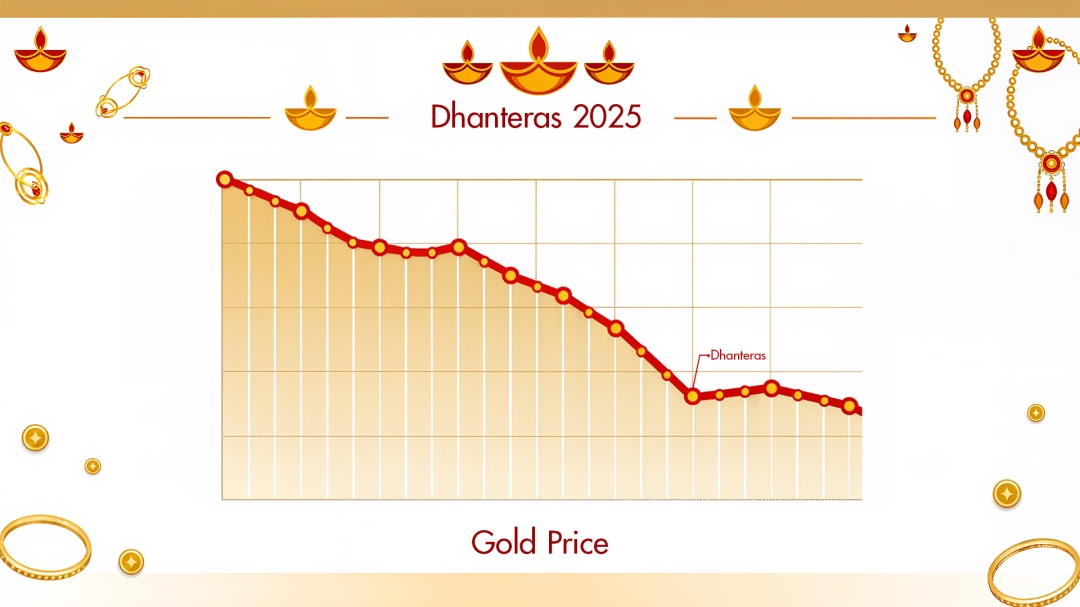

Mumbai, India - As the festive season approaches, gold rates in India often become a key focus for both consumers and investors. Traditionally, Dhanteras marks the beginning of the Diwali festival, a period when gold purchases are considered highly auspicious. However, in a surprising turn of events this year, gold prices experienced a slight dip just a day before Dhanteras, prompting questions among buyers and market watchers alike. This report explores the reasons behind the drop, the underlying market dynamics, and what it means for consumers during the festive season.

Understanding the Dip in Gold Prices

Gold in India is influenced by a combination of domestic and international factors, which together shape daily price movements. Ahead of Dhanteras 2025, analysts observed a modest correction in gold prices. While the dip was not significant enough to disrupt the traditional buying patterns, it did reflect several ongoing trends in both the local and global markets.

Market analysts attribute this short-term decline primarily to profit-booking. Gold prices had witnessed a consistent upward trajectory over the past few months, leading some investors to realize gains ahead of the festival. This natural market behavior, combined with minor fluctuations in international bullion markets, contributed to the marginal easing of domestic gold rates.

Another contributing factor was the fluctuation in the Indian Rupee’s value against the US Dollar. As India imports a majority of its gold, currency movement directly affects local gold prices. In the days leading up to Dhanteras, the Rupee experienced minor strengthening against the Dollar, which exerted downward pressure on gold rates.

Domestic Demand Patterns and Festival Dynamics

India’s gold market is highly seasonal, with consumer demand peaking around auspicious occasions such as Akshaya Tritiya, Dhanteras, and Diwali. These periods often see an uptick in purchases of gold jewelry, coins, and bars. While the dip in prices might have seemed counterintuitive, it also coincided with a shift in consumer behavior.

This year, buyers appear to be favoring smaller denominations of gold, such as 2g, 5g, and 10g coins, instead of large jewelry pieces. Lightweight jewelry and coin-based purchases have been gaining traction among younger consumers, particularly in urban centers like Mumbai, Delhi, and Bangalore. The trend is attributed to both affordability and ease of gifting, particularly during the festival season.

Retail jewelers reported a slightly lower footfall for gold purchases compared to last year; however, overall revenues matched the previous year due to the uptick in gold prices. Meanwhile, silver purchases showed an increasing trend among buyers, indicating that festival sentiment continues to drive demand. Many consumers interpreted the dip as an opportunity to make timely purchases, while others continued with pre-planned buying strategies based on auspicious timing and personal budgets.

Gold Purity and Pricing Considerations

In India, gold purity is measured in karats, with 24K being the purest, followed by 22K, 18K, 14K and 9K. The dip observed in the market was consistent across these purities, although 22K gold, also known as 916 gold, remained the most sought-after choice for jewelry during Dhanteras. This is due to its combination of high purity, durability, and suitability for intricate designs.

18K gold, containing a higher proportion of alloy metals, also saw demand, particularly for diamond-studded and gemstone jewelry. 14K gold, though less common in India, appeals to buyers seeking more durable and affordable daily-wear options. Even with the marginal price correction, consumers continued to prioritize purity and hallmarking, ensuring trust and quality in their festive purchases.

Role of BIS Hallmarking and Consumer Assurance

The Bureau of Indian Standards (BIS) hallmarking system provides assurance of purity and quality for gold buyers. Most jewelers display hallmark-certified gold rates, helping consumers make informed decisions. The hallmark includes details such as purity mark, the BIS logo, and a unique HUID number. This year, hallmarking played a significant role in consumer confidence, particularly as buyers were navigating slight fluctuations in rates ahead of Dhanteras.

Influence of International Gold Markets

International gold prices are a key driver of domestic gold rates in India. Global factors such as bullion demand, geopolitical developments, and US Federal Reserve policies all have a cascading effect on local rates. In the week leading up to Dhanteras, global gold prices witnessed minor corrections, which were mirrored in India. While international rates are denominated in US Dollars per ounce, domestic prices are converted into Indian Rupees per gram, factoring in import duties, currency exchange rates, and GST.

Government Taxes and Duties

Government-imposed taxes also influence consumer buying decisions. Currently, a 3% GST is applicable on gold coins, bars and jewellery. Additionally, custom duties affect imported gold, contributing to slight variations in local rates. During the festive season, consumers often factor these charges into their budgets, further explaining the popularity of smaller denomination coins and lightweight jewelry during the recent dip.

MCX Gold Rates and Digital Market Tracking

Modern investors frequently track gold rates through the Multi Commodity Exchange (MCX), which provides real-time updates on gold futures. While physical gold remains the preferred medium for festive purchases, ETFs, digital gold, and gold mutual funds are gaining popularity among urban investors. These platforms allow buyers to respond quickly to market fluctuations, such as the recent dip before Dhanteras, and make timely purchases.

Historical Context: Gold Prices and Festivals in India

Historically, gold has been both a cultural symbol and a financial asset in India. Dhanteras, marking the beginning of Diwali, traditionally sees a surge in gold buying, as it is believed to bring prosperity. However, minor corrections like the one observed this year are not uncommon. Over the past decade, gold has exhibited a generally upward trajectory, with occasional short-term dips influenced by global events, policy shifts, or profit-booking by investors.

For consumers, understanding these patterns is crucial. A short-term dip does not necessarily indicate a long-term decline. Instead, it may provide an opportunity for timely purchases, especially for festive gifting, weddings, and investments in smaller denominations.

Expert Insights on the 2025 Dip

Financial analysts suggest that the dip ahead of Dhanteras was largely due to short-term market dynamics rather than a structural change in gold demand. Profit-taking, currency fluctuations, and international market trends were key contributors. Analysts emphasize that, despite the dip, long-term prospects for gold remain robust, driven by India’s continued cultural affinity for the metal and its role as an inflation hedge.

One market expert noted, “Gold in India is unique because it combines investment value with cultural significance. Even minor dips, like the one seen in this Dhanteras, do not deter buyers from making festival purchases. In fact, it often encourages timely decision-making.”

City-Wise Observations

Different cities in India exhibit slight variations in gold rates due to local demand and supply dynamics. For instance:

-

Mumbai and Delhi: Observed slight easing of gold prices with strong footfall in retail stores.

-

Bangalore and Hyderabad: Demand was steady for smaller coins and lightweight jewelry.

-

Chennai and Kolkata: Traditional buyers continued to prefer 22K gold jewelry for wedding rings and gifting.

These variations reflect not just economic factors but also cultural preferences and purchasing habits. Urban centers with higher disposable incomes saw more strategic buying, leveraging the marginal dip to acquire festive jewelry and coins.

Consumer Behavior and Festive Buying Trends

The consumer response to the recent dip highlights evolving purchasing patterns. While large gold jewelry remains desirable for weddings and special occasions, there is a noticeable trend toward:

-

Lightweight necklaces, bangles, and rings

-

Gold coins and bars in smaller denominations

-

Gemstone-studded and diamond-set jewelry (especially 18K gold)

Retailers reported that younger consumers are increasingly using online platforms to compare rates, check hallmarking, and make purchases, reflecting a more informed and strategic approach to festive gold buying. Even as gold dipped slightly, the market witnessed strong participation, indicating confidence in both cultural and investment value.

Amid these market movements, established jewelry brands like Lucira Jewelry continue to offer consumers access to hallmark-certified pieces. While gold remains a dominant choice during Dhanteras, many buyers are also exploring other festive jewelry options, such as Lab Grown Diamond Jewellry, for gifting and personal use. This highlights the diverse preferences of modern Indian consumers during peak festival seasons.

Investment Implications

For investors, the pre-Dhanteras dip serves as a reminder of the cyclical nature of gold markets. Long-term investment strategies, such as investing in physical gold coins, bars, or ETFs, can help mitigate short-term fluctuations. Analysts recommend monitoring international trends, currency movements, and local demand patterns to make informed decisions.

Calculating returns on gold investments over the past decade shows that, despite periodic dips, gold has consistently outperformed traditional fixed-income instruments, making it a reliable medium- to long-term investment. Investors aiming for strategic purchases during festivals can benefit from short-term dips to optimize returns.

Global and Domestic Economic Drivers

Several macroeconomic factors influence gold prices in India:

-

Global bullion trends: International gold prices affect domestic rates via import costs.

-

Currency exchange rates: The INR/USD ratio directly impacts the cost of imported gold.

-

Inflation and interest rates: Gold serves as a hedge during periods of rising inflation and low interest rates.

-

Geopolitical tensions: Events such as wars, trade conflicts, or pandemics can increase demand for safe-haven assets like gold.

Domestic policies, including import duties and GST, further shape the retail price landscape. During Dhanteras, these factors collectively influence both pricing and consumer behavior.

Cultural Significance of Gold During Dhanteras

Beyond its financial value, gold holds deep cultural importance in India. Dhanteras marks the purchase of new wealth, with gold considered auspicious for prosperity and health. Families often purchase coins, bars, or jewelry to mark the occasion, making gold not only an investment but also a part of religious and cultural practice.

This cultural attachment ensures that even when prices dip, demand remains resilient. Retailers reported sustained purchases across all purities, highlighting gold’s unique position as both a spiritual and economic asset in India.

Conclusion

The slight dip in gold prices ahead of Dhanteras 2025 reflects short-term market dynamics rather than a long-term decline. Factors such as profit-booking, international trends, currency fluctuations, and shifting consumer behavior contributed to this correction.

For consumers, the dip provides an opportunity to make informed festive purchases, whether in the form of coins, bars, or hallmark-certified jewelry. Urban buyers, in particular, are leveraging this moment to secure lightweight and small-denomination purchases, while traditional buyers continue to prioritize purity and hallmarking for weddings and gifting.

Investors and consumers alike should note that gold remains a reliable medium- to long-term investment, combining cultural significance with economic value. Brands like Lucira Jewelry continue to support buyers with hallmark-certified options, enabling informed and confident purchasing decisions during the festive season.

As India heads into Dhanteras and the broader Diwali period, the slight pre-festival dip is unlikely to alter long-term demand, reaffirming gold’s enduring appeal as a store of value, a cultural asset, and a festive tradition.

For more details, visit: https://www.lucirajewelry.com

Media Contact

Company Name: Lucira Jewelry

Contact Person: Aryan Sanghani

Email: Send Email

Phone: 8169205601

Address:1402-2, DLH Park, SV Road, Rani Sati Nagar Goregaon(West)

City: Mumbai-400062

State: Maharashtra

Country: India

Website: https://www.lucirajewelry.com/